does unemployment reduce tax refund

For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. In the For Period Beginning field enter the first day of the pay period that the refund affects.

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

In the Refund Date field enter the deposit date.

. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. The unemployment tax refund is only for those filing individually. If youre married and filing jointly you dont have to pay taxes on the first 20400.

The first refunds are expected to be issued in May and will continue into the summer. File unemployment tax return. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may.

In the latest batch of refunds announced in November however the average. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

A tax refund which occurs when a tax filer overpays their federal income taxes can be reduced to. The tax on businesses that Iowa uses to fund benefits for unemployed workers will drop to the lowest rate in more than two decades Gov. One thing to keep in mind however is that SSDI and unemployment have a complicated relationship with each other.

Many filers are able to protect all or a portion of their income tax refunds by applying their bankruptcy exemptions to the expected refund. Generally after using all of your available exemptions the remaining unprotected amount is often little or nothing. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes.

Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. While it may be tempting to promise your tax refund to several time-sensitive bills or urgent needs remember that it can take up to 21 days for a tax refund to be delivered. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria.

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. The IRS has sent. Read on and watch this brief video to learn more about how these two types of benefits affect each other.

Ad If You Have IRS Issues No Matter How Big Embarrassing Or Scary Our Tax Pros Can Help. Reduce the amount you report on line 7 by those contributions. This includes unpaid child support and state or federal taxes.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to pay you after you stop working You cannot file until the last payment is received but the payments do not reduce your benefits Severance or Bonus Pay.

As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first 10200 in unemployment income. Federal agency non-tax debts. Why does my unemployment 1099-g lower my refund by 50.

Make sure you include the full amount of benefits received and any. The announcement comes. Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to.

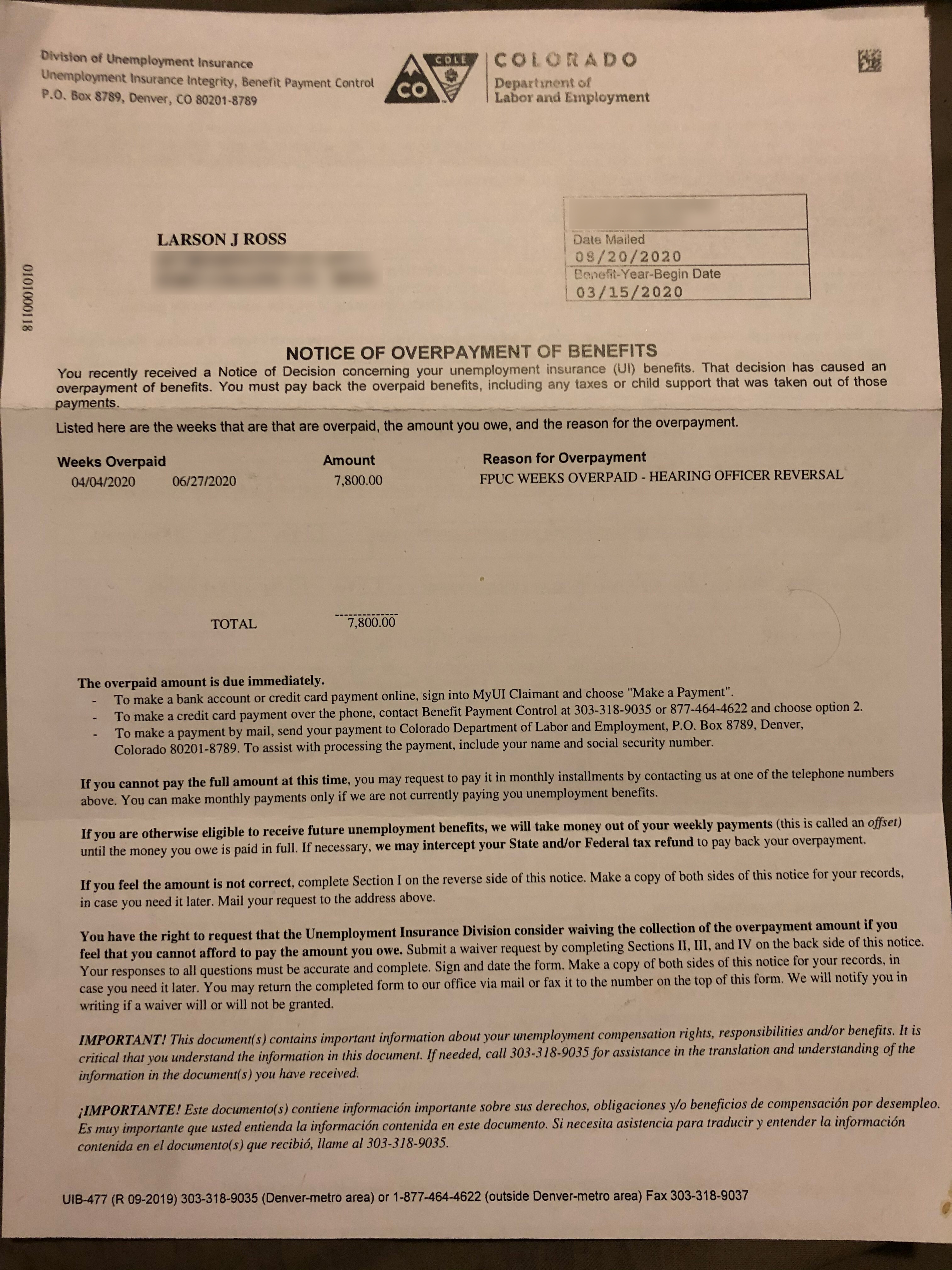

Report unemployment income to the IRS. Unfortunately an expected income tax refund is property of the bankruptcy estate. But the unemployment tax refund can be seized by the IRS to pay debts that are past due.

Dont bank everything on an incoming refund. If you are itemizing. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. Our Tax Pros Can Work With The IRS So You Dont Have To From Start To Solution. People who received unemployment benefits last year and filed tax.

Select the name of the vendor who submitted the refund check. Kim Reynolds said Wednesday. If you received more than 10200 in unemployment or.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. If you are receiving unemployment benefits check with your state about voluntary withholding to help cover your income taxes when you file your tax return. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities.

The IRS will automatically refund money to people who already filed their tax return reporting unemployment compensation or in some circumstances the IRS will apply the refund money to tax debts or other debts owed by the person entitled to the refund. If the amount of unemployment repayment is more than 3000 calculate the. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Fillable Form 940 2018 Payroll Taxes Tax Forms Payroll

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Tax Filing Services Provider Company Tax Return Services In Usa Hcllp Tax Reduction Tax Services Income Tax Return

The Case For Forgiving Taxes On Pandemic Unemployment Aid

How Unemployment Can Affect Your Tax Return Jackson Hewitt

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace